Is the global economy headed for a recession? Will it happen or wont it ? …This is the million dollar question that most of the world seems to be asking!!

Arguments both ways are doing the rounds in many countries….Economists, policy makers, business leaders, market pundits are as confused as the general public on what the future holds.

Read on for an explainer …..

Background

Countries across the world are currently witnessing –

- a prolonged energy crisis (reduced Russian gas supplies to Europe) with alarming consequences and impact of energy shortages and surge in energy prices for the common public.

To read more about the impact of the Ukraine war on Global Energy trade refer to our earlier article – Economic Impact of the Ukraine Conflict – ofmoneyandmoney

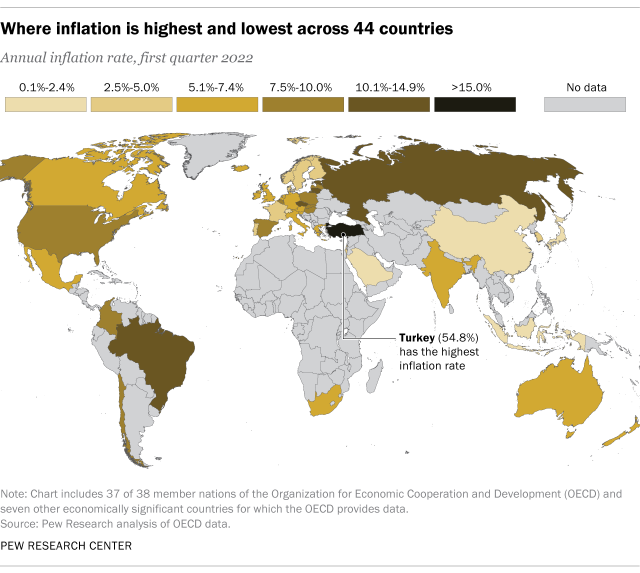

- Red-hot inflation (all round spurt in prices of goods and services). Record high Inflation rates of around 10% and more are being seen in economies such as Turkey, the US, England and the whole of Europe etc. making it the top priority to handle for Governments.

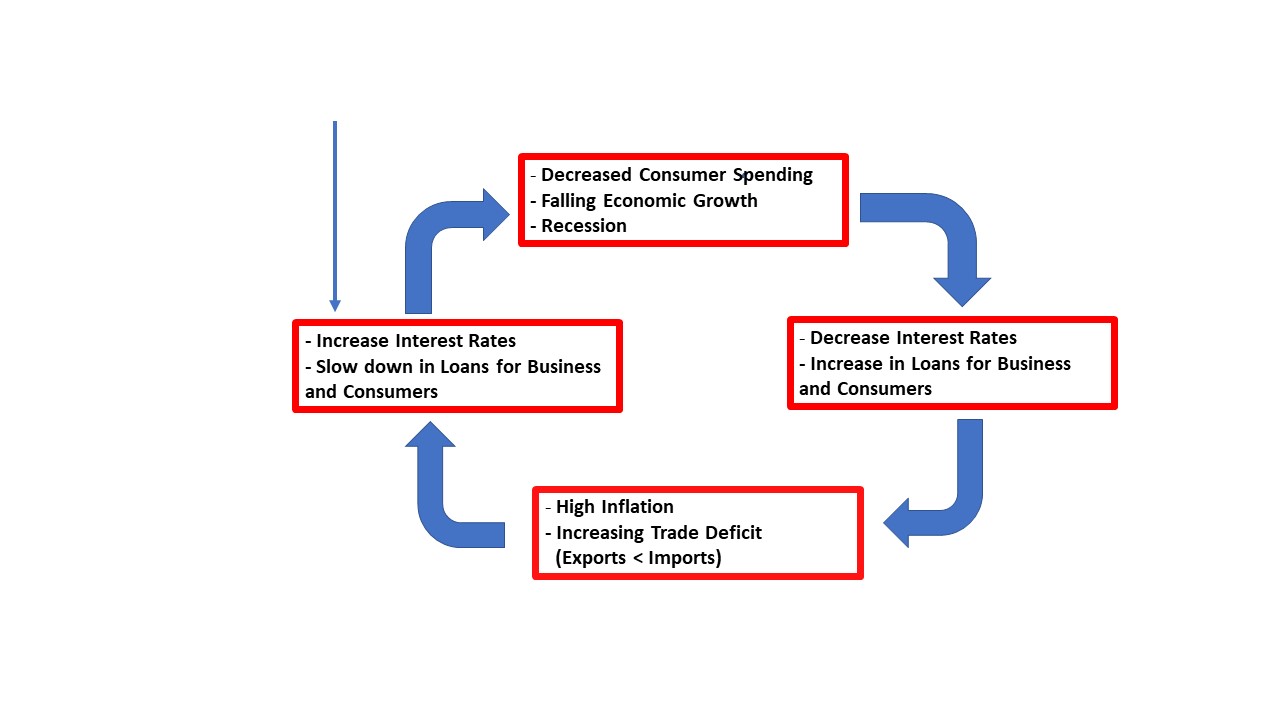

- Sharp rise in interest rates – To tackle the rising inflation, global monetary policies are being tightened by many central banks (mainly, rise in interest rates) which is surely starting to slow down growth, but delaying this increase will only exacerbate the hardship for people going forward due to unprecedented rising inflation.

To get more info on the link between inflation and interest rates refer to our earlier article Why is Inflation a Four-Letter Word for the Markets? – ofmoneyandmoney

All this is leading to the conviction that the world economy is headed towards a recession. Recently, the International Monetary Fund (IMF) has also warned that surging inflation and the Ukraine war may push the world economy to the brink of recession.

So what exactly is Recession??

The commonly recognised definition of Recession is when ‘two quarters of declining GDP’ is witnessed by a country. This is a rule of thumb that does not officially define a recession.

This term actually means a significant decline in economic activity that is spread across the economy and that lasts for more than a few months and not necessarily for only 2 quarters. For more explanation on Recession click here.

For a clearer understanding, the cyclical link between inflation, interest rates and Economic Growth is shown below highlighting where we are currently.

Current Scenario – So far the increase in Interest Rates in India has not yet witnessed a slowdown in Loans given to businesses and consumers which normally happens with a lagged effect.

The IMF’s recently released data is summarised below –

- World growth had rebounded in 2021 to 6.1% after the COVID-19 pandemic crushed global output in 2020 with a 3.1% contraction.

- Global real GDP growth (actual growth less inflation) is expected to slow to 3.2% in 2022. The fund has also cut its 2023 growth forecast to 2.9% citing the impact of tighter monetary policies across countries.

- And in the event of a complete cut-off of Russian gas supplies to Europe, year-end Global growth would fall to 2.6% in 2022 and 2% in 2023, with growth virtually zero in Europe and the United States in 2023.

All in all it appears that the movement of key economic indicators in the coming months of 2022 will give a clearer picture of whether a world-wide Recession is well and truly upon us or will it limited to specific countries only.

We have attempted to bring to you an analysis of how the economic situation currently is in India and in some of the other big economies of the world and their forecasts.

India

External Trade Scenario

India’s Trade deficit (Imports > Exports) widened to a fresh record of almost $30 billion in July as export growth slowed to a 17-month low led by weak global demand. This number however has come down slightly to $ 28 bn in August.

Imports stayed near the record-high levels due to a weaker rupee. Crude imports, which comprises about one-third of India’s imports, and coal with an 8% share, primarily contributed to the rise in imports.

Exports – India’s deep linkages with the US economy would mean any slowdown in the US economy will have a strong impact in the fall of growth rate of India’s GDP. Around 18 per cent of India’s merchandise exports and 60 per cent of IT and IT Services exports are dependent on the US market.

Fall in exports would however be offset by partially lower imports because of lower commodity and raw material prices.

Inflation and Interest Rates Scenario

Latest Inflation and interest rate data show that retail inflation (Consumer Price Index) repeatedly breached the RBI’s upper tolerance limit of 6% and increased to 7% in August (from 6.71% in July and 5.3% in June) driven by high food and fuel costs. This will most likely put pressure on the RBI to raise interest rates again to control inflation.

The other reasons that would put pressure on the Reserve Bank of India (RBI) to hike India’s interest rate even further is –

- the central bank of the US – the US Federal Reserve has hiked US domestic interest rates multiple times this year with clear indications that a further hike is round the corner. This has been to counter soaring inflation in the US of around 8%, similar to what other economies around the world are experiencing.

- this is likely to further reduce forex inflows into India as international investors would tend to prefer the less risky investment in the US government borrowings/debt markets rather than bring in their money to emerging markets like India, which will continue to weaken the Indian rupee.

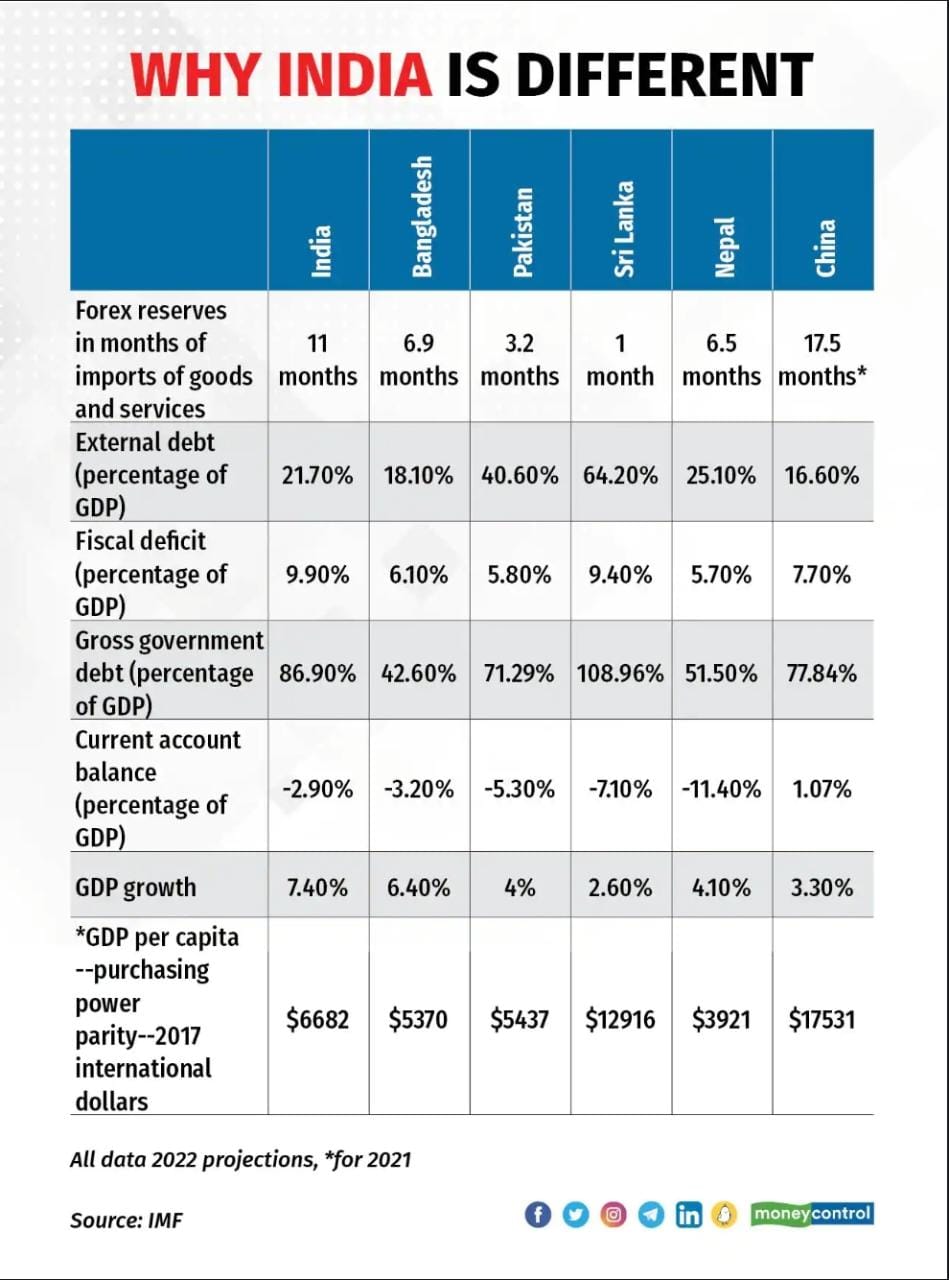

- However, experts feel that India’s strong foreign exchange reserve and relatively lesser external debt will help India ride out any challenge emerging on the external front. They expect India’s forex kitty to grow back to $600 billion by the end of this year. Forex reserves have been declining slowly week on week and stood at USD 561 billion as of August 26th.

However, a worrying aspect in all this is that factory production output plunged to a four-month low of 2.4% in July falling sharply from 12.7% in June thereby posing greater challenge to the RBI to undertake the difficult balancing act of raising interest rates to control inflation without impacting economic activity and growth.

A comparison of India with other neighbouring South Asian countries is shown in the table below. This shows clearly why India is better positioned to withstand the current difficult times.

Forecast

- The IMF, in its latest July update on the world’s economic outlook (WEO), has brought down India’s growth forecast for 2022-23 to 7.4% still among the highest in the world.

- While slowdown in the global economy could impact India’s growth prospects experts also suggest that there is a lesser probability of a sharp slowdown in the economy backed by strong domestic demand. Bank Credit to industry continues to register a strong growth of 15.5% for the week ending August 26th registering its highest growth in nine years.

- Most of the indicators in the services sector have shown a significant rebound in the past two months. Recent data suggests that consumers are also more optimistic about economic prospects.

- The three global ratings agencies Moody’s, S&P and Fitch have retained a ‘Stable Outlook’ for India expecting that the difficult global conditions are unlikely to derail India’s economic performance significantly.

- The projection of decline in oil prices bodes well for India’s inflation outlook and could influence the pace of interest rate hikes by the Reserve Bank of India.

- The policy focus should be on macro-economic stabilisation, consolidating the gains from export competitiveness and inflation targeting.

To Sum up the key takeaways are –

- A fall in India’s exports should be offset by partially lower imports because of lower international commodity and raw material prices, but to what extent will the prices fall will determine the pressure on India’s Trade Deficit.

- The extent of interest rate hike by the US Federal Reserve will determine not only it’s domestic economic growth but also that of other economies as well as forex inflows into India.

- The RBI has a tough ask to balance out hiking interest rates further without impacting economic growth.

As mentioned above, India seems to be bucking the trend of slowdown in growth is concerned. We are not blazing ahead but the slowdown is not as sharp as other economies.

A recession certainly would bring a lot of economic hardship and thereby performance of the equity markets. Typically a slowdown affects corporate profitability which in turn would impact the stock price which will bring down the indices. India has been a good steady performer this year and has also attracted Foreign Institutional Investor’s inflows lately.

The question though is that if the world goes into a recession, can India still continue on its growth trajectory? Well, if can stay the course, ours will be the market which will have a roaring rally and we can and should ride it to make some serious money.

We need to watch the indicators very closely and decide on whether to jump into the equity markets.

But if recession hits, then bonds should be a safer place to hide. As rates have to be lowered if recession hits which increase the price of bonds.

You can read further for details on the forecasts of other large Economies such as the US, UK, China, Germany and other European countries read further.

______

US

The nation’s GDP fell 1.6 percent on an annualized basis in first quarter 2022 and was followed by a 0.9 percent drop in the second quarter. The IMF has confirmed its forecasts of 2.3% growth in 2022 and 1.0% for 2023, which it previously cut twice since April on slowing demand.

Experts say that it has been observed that since 1955 “the U.S. economy has always experienced a recession within two years from every quarter in which inflation was above 4% and unemployment was below 5%, as they are today.”

However, we find that most indicators—particularly those measuring labour markets—provide strong evidence that the U.S. economy did not fall into a recession in the first quarter. According to latest figures released by the Labour ministry employment numbers have been showing an increase and the unemployment rate rose only marginally to 3.7% in August from 3.5 and 3.6 in July and June respectively.

So the performance of economic indicators over the balance months of 2022 and early 2023 will indicate which way the US economy is likely to go.

China

The IMFs China 2022 GDP growth forecast has been brought down to 3.3%, on account of COVID-19 outbreaks and widespread lockdowns in major cities that have curtailed production and worsened global supply chain disruptions.

The IMF also said the worsening crisis in China’s property sector was dragging down sales and investment in real estate. It said additional fiscal support from Beijing could improve the growth outlook, but a sustained slowdown in China driven by larger-scale virus outbreaks and lockdowns would have strong spill overs.

For the Chinese economy also the performance of economic indicators over the balance months of 2022 and early 2023 will indicate whether Recession is likely to set in.

Germany

Germany, Europe’s largest economy, with its high reliance on Russian Gas is facing surging energy costs and a persistent shortage of supplies. Also, tourism services aren’t seeing the same level of tourism boom seen in other countries in the Mediterranean as vacation travel picks up post-Covid.

Russia supplied more than half of Germany’s gas in 2020 and about a third of all oil. Since the outbreak of war, the Kremlin has throttled supplies, blaming technical problems for a fall in volume through the key Nord Stream 1 pipeline.

In response to the energy crisis, Berlin will impose a gas levy for households, due to come into effect from October and lasting until April 2024, which is designed to spread the higher wholesale cost between households and industry.

Further data expected shortly will reveal whether the minor contraction initially reported, will be revised into a bigger one, or whether consumer spending was strong enough to avert a decline in output — for now.

High inflation to just under 9% in July led the European Central Bank raised rates by half a point in July and is waiting for August data to see where their monetary policy is headed. On balance, experts feel that the chances for a Recession are high especially towards the end of this year and 2023.

UK

In the UK, inflation is soaring and is above 10% for the first time in 40 years as households struggle with rising energy bills. Already almost double their levels of a year ago, the new Prime Minister is addressing this problem as top priority.

Higher-than-expected public borrowing figures on Friday underlined the hard decisions facing the new Prime Minister about how to expand help for the poorest households, which has so far fallen short of support given by most other European governments.

The Bank of England forecasts that inflation will peak above 13% over the next few months and that the economy will fall into a lengthy recession.

The deteriorating picture for the UK comes after the Bank of England warned this month of a 15-month contraction from the end of this year, worse than the outlook for other big European economies and the United States.

France

France should be better insulated than many other European nations, thanks to its large nuclear energy sector, which accounts for just over 70% of its electricity generation, but it has been struggling with serious faults at ageing reactors. Although in a less dangerous position than Germany, the eurozone’s second-biggest economy could still face damaging power cuts this winter.

GDP rose in France by 0.5% in the second quarter, lower than in other nations across the continent, with domestic consumption notably weak. The government has put in place an emergency support package worth €20bn, including tax cuts at petrol pumps, while capping an increase in regulated electricity prices at 4%, a policy helped by state ownership of the energy giant EDF.

Italy

The Italian economy has performed much more strongly recently than its big eurozone rivals, notching up growth of 1% in the second quarter. But like Germany, Italy is heavily dependent on Russian gas and has the added complication of being thrown into a fresh bout of political uncertainty after the resignation of its prime minister earlier this summer.

In early August, Italy approved a new aid package worth about €17bn for consumers and businesses, in one of the PM’s final acts as leader. A tax cut on petrol and diesel has also been extended to 20th September.

Since the creation of the single currency almost a quarter of a century ago, Italy has been the weakest performing of the “big four”, with living standards barely higher than at the end of the 1990s. It is benefiting this year from a boost to tourism, which accounted for 13% of its GDP before the pandemic. But the IMF said last week that Italy could suffer a deep recession under a Russian gas embargo.

Spain

Like every other country in Europe, Spain is affected by the war in Russia but of the big four it has the best chance of avoiding recession, despite soaring inflation.

There are a number of reasons for this. Its economy went into the crisis in reasonably good shape and – like Italy – has been given an added boost by the surge in tourism after the pandemic. Tourism accounted for 12% of Spain’s GDP before Covid and an even bigger share of employment.

Also, Spain is much less reliant on Russian energy than Italy, and is already a big importer of liquefied natural gas from around the world. GDP rose by 1.1% in the second quarter and the IMF expects it to be the fastest growing of the big four next year.

The government has put in place €16bn of financial aid and loans to help companies and households with soaring energy costs.

Russia

Russia has suffered under the West’s sanctions, plunging its economy into a deep recession and forcing the Kremlin to default on its foreign debts for the first time since 1918, though soaring energy prices and exports have helped blunt some of the impact.

Russia’s current account balance – measuring trade and investment flows has more than tripled to hit a record $167bn surplus in the second quarter, helped by high wholesale oil and gas prices swelling exports, while western sanctions led to a fall in imports. The proceeds have been a vital source of hard currency for Moscow, reflected in the rouble erasing losses seen since the start of the invasion.

However, over the long run experts say Russia’s economy will struggle with the loss of western technology and investment and could lead to Recession even if not catastrophic.

Krishnan

👏👏👏

Very well explained and articulated Usha

Well researched 👍

Usha

thank you so much!

shanker. K

India appears better place to live in..

Globe trotting? Absolutely No/No…

Bringing the global perspective , makes this article interesting

Usha

thank you very much!

Indeed at this point in time…India is in a better position.

Sejal Goel

A very good and serious piece of information. The best part I take from this whole is that India will not be impacted much…..

Brilliant article Usha. So much information but put it in such a way that it is not overwhelming. We can choose and pick what we want to read and what we would like to skip. Very clearly it is presented that way.

Such complex information made easy and understandable for people like us.. This platform brings my understanding for many financial markets/issues clarity. I am so happy to have this platform which gives us wonderful topics and insights without even asking it. Thank you so much for bringing different topics, not so easy topic, complex topics made available to a person like me in a very simple language.

Keep writing and keep surprising us with new brilliant topics. Waiting for more…

Usha

thank you!

yes at this point in time..India is better off comparitively..

Sarika

A fantastic read for anyone looking to understand how the interconnected global economic and political factors are likely to impact India’s economic growth and key indicators. Thanks for making the complex set of dynamics so easy to understand and read.

Usha

thank you for your feedback!

Vipul

Thanks for the simple language and structured flow – which has made a complex subject matter like this easy to understand. Based on this; I am thinking of a) Staying invested in India; b) Buy on dips in US and China and c) exit out of Europe.

Vipul

Thank you for explaining in simple words and in a logical flow. Based on my understanding from the above; I am thinking of : a) Staying Invested in India; b) Buy US and China on dips ; and c) exit Europe.

Thanks for the research and insights !