Indians love gold. The sparkle of gold jewellery will blind your eyes if you walk into a wedding of a well-heeled family.Apart from its use for jewellery, gold universally is considered a hedge against inflation. It’s a belief that in times of uncertainty investors flock to gold as a safe haven asset.

The pandemic hit first and then the Ukraine conflict, runaway inflation, clearly, the world economies are not in a good space. Inflation in the US is at a 40-year high, and Indian inflation is also at 7.41% well above the tolerance limit of 6%.Historically, this kind of scenario augurs well for precious metals like gold as investors expect it to rally.

Apart from buying gold physically in jewellery or gold coins, there are easier other ways to invest in gold.

In the non-physical space, Indian investors can mainly invest in –

- Gold Exchange-Traded Funds(ETFs)

- Gold Mutual Funds

- Sovereign Gold Bonds (SGBs)

- Emerging Trend – Digital Gold

Gold ETF

ETFs or “exchange-traded funds” are exactly as the name implies: funds that trade on Stock Exchanges. A Gold ETF is an exchange-traded fund (ETF)that aims to track the domestic physical gold price by investing in gold bullion and keeping them aside in lockers or vaults.

In short, Gold ETFs are units representing physical gold which may be in paper or dematerialised form. One Gold ETF unit is equal to 1 gram of gold and is backed by physical gold of very high purity.

Gold ETFs are listed and traded on the National Stock Exchange of India (NSE) and Bombay Stock Exchange Ltd. (BSE) like a stock of any company and can be bought and sold continuously at market prices. However transaction volume is low,thereby impacting the liquidity (ability to sell the holdings and get cash in return) of such investments.

Because of its direct gold pricing, there is complete transparency on the holdings of a Gold ETF,further due to their unique structure and creation mechanism, they have much lower expenses as compared to physical gold investments.

Some examples of Gold ETFs are:

1. Aditya Birla Gold ETF – Symbol: BSLGOLDETF

2. Nippon Gold ETF – Symbol: GoldBeEs

3. SBI Gold ETF – Symbol: SBIGETS

You can invest in Gold Etfs via your stockbroker.

Gold Mutual Funds

A gold fund is a mutual fund scheme that is open-ended (a scheme that is available for subscription and repurchase on a continuous basis without a fixed maturity period). The investment of these mutual funds is done in units of different ETFs of gold. In other countries, gold mutual funds also invest in gold mining or distributing companies.

How Gold Funds are different from Gold ETFs?

- Pricing:Units of Gold Funds are priced differently as compared to gold ETFs. The price of a gold fund is by way of its NAV like other Mutual Funds. However, Gold ETFs are listed on the stock exchange and one can get real-time updates about their price similar to a share.

- SIPs:You can invest in gold funds through SIPs. However, there is no automatic SIP option in gold ETFs.

- The Minimum Investment Amount:Owning one unit of gold ETF is equal to owning 1 gram of gold. Thus, the minimum investment amount in gold ETF depends on the prevailing price of gold in the market. In gold Funds, one can invest/start an SIP of a nominal amount of as low as Rs. 1,000.

- Transaction Cost:There are no transaction costs for investing in gold ETFs. However, gold funds may charge an exit load if you want to redeem your units within the predefined lock-in period. As for Mutual Funds, there are charges that are paid by the gold Funds.

- Expense Ratio:The expenditure involved in managing gold funds is more than gold ETFs. As gold funds invest in gold ETFs, hence, the expense ratio of the former would include the expenses of the latter.

- Liquidity:Liquidity: On account of being listed on stock exchanges, gold ETFs “technically” offer higher liquidity than gold funds. As the former does not charge any exit loads, you can buy/sell the units at any time during market hours. Units of gold funds can be redeemed by selling them back to the fund house based on the NAV for the day.

Some examples of Gold mutual funds are :

- HDFC Gold fund

- SBI Gold fund

- Axis Gold fund.

You can invest in these via your mutual fund distributor or directly from the site of the mutual fund ie(Asset management companies.)

Taxation of Gold funds & gold ETFs is as per a debt mutual fund. If the holding period is less than 36 months than the gains are taxed at the individuals slab rate & if more than that then gains are taxed @20% with indexation.

Sovereign Gold Bonds

With the aim to offer an alternative to physical gold, the Government of India introduced the Sovereign Gold Bond (SGB) Scheme.

- Sovereign gold bonds are certificates issued by the RBI against grams of gold. The minimum investment is 1 bond, which represents 1 gm of gold & maximum a person can buy is 4 kg per fiscal year.

- These allow individuals to invest in gold without the hassle of keeping the physical gold safe.

- The SGB value is denominated in multiples of gold grams. Since these bonds are issued by the RBI on behalf of the Government of India, there is a specific window for the subscription. The RBI normally announces the issuance of fresh sovereign bonds through a press release every 2-3 months.

- The price of the SGB is notified by the Government and is based on the prevailing price of gold.

- The bond has a maturity of eight years from the date of the issue and is redeemable at the prevailing price of gold at the maturity date. Early redemption is allowed via RBI after the completion of the fifth year.

- SGBs pay an interest rate of 2.5% on the issue price payable half yearly. Interest is taxed at the slab rate.

- These bonds are tradable on the stock exchanges after 15 days of issuance. Volumes traded are a bit low on the exchanges but have picked up somewhat.

- SGB s are sold through offices or branches of Nationalised Banks, Scheduled Private Banks, Scheduled Foreign Banks, designated Post Offices, Stock Holding Corporation of India Ltd. (SHCIL), and the authorised stock exchanges either directly or through their agents.

- If the SGB is held till maturity of eight years, the capital gain on appreciation is exempt from tax. If it is sold in the market or redeemed early the gains are taxed like a debt fund ie post 36 months of holding @20% with indexation. If redeemed before 36 months then the gains are then taxed at the slab rate.

Emerging Trend – Digital Gold

Digital gold is a new mode of investing in physical gold. 24 karat Hallmark Gold can be bought online for as little as ₹1 and is stored in insured vaults by the seller on behalf of the customer. To sell, investors can sell their digital gold for cash, via their bank account, through a live 24/7 market-linked rate.

Digital gold, is vault-stored, 24K pure gold that users can access via digital channels including e-commerce portals, wealth management channels, banking, and payment apps.

However, Digital gold, being a relatively new offering in the country, does not have regulations guiding it yet. According to recent industry reports, it is expected that the regulators are looking at framing guidelines for the sector. Hence, readers are advised to watch and wait for proper rules to be framed and govern this sector.

Safegold, Augmont gold, and MMTC are a few companies that offer digital gold.

Despite the easy options to invest,overall the attraction of gold for Indians has declined significantly. The share of gold & silver ornaments has fallen from 1.7% of savings to 1% in just 5 years.

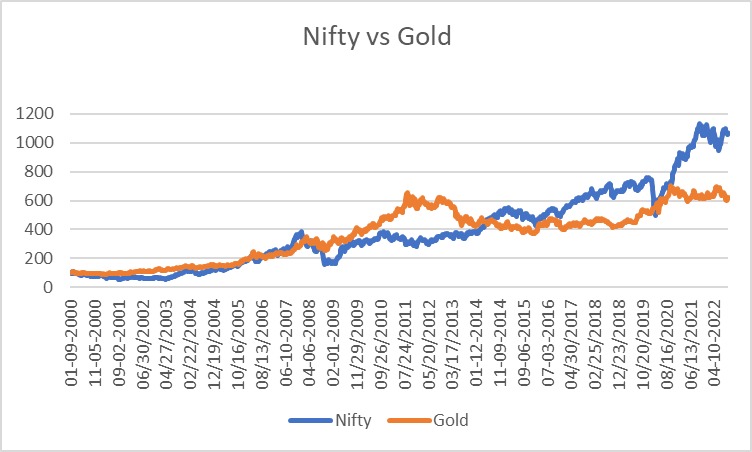

As seen above, in the last 10 years, Gold returns have disappointed investors as compared to Nifty/Sensex returns. Central banks all over the world have raised interest rates by 125-300 bps (1.25 to 3%) this year. This has pushed up yields or returns from safe government bonds. Typically investment in gold does not yield any interest so there is an adverse impact on gold prices.

The dollar has also seen a steep appreciation against almost all currencies. There is an inverse relationship between dollar value & gold prices. Inflation is still raging ahead and the central bank has a firm resolve to keep raising interest rates until they control it.Hence the outlook for gold is not very positive in the near term. Competition from digital currencies like bitcoin, higher transaction and storage costs add to woes of gold.

Even so, gold finds a place in almost all portfolios as it has a long history and has periods of out performance against stocks.

If prices depress further, it may be a good entry point to enter.There is a long association between Indians with gold, and it is observed that stock market volatility worries retail investors but if gold prices remain low for a long time, for some reason, it does not cause too much grief to them.

Out of all the above methods of investing in gold, we believe Sovereign bonds are the best option if your investment horizon is long.

Gold funds ETFs /funds may work if you need liquidity or may want to invest in gold for the short term.

shanker. K

Interesting..

How are the returns of gold in comparisons to the other commodities??

J S

When will gold start reacting to the high inflation. It doesn’t seem to be moving as of now

admin

Gold as an inflation hedge is no longer a surefire formula as in the 1970’s. Higher interest rates maybe weighing on gold prices as gold is not an interest bearing asset.Dollar strength may also be weighing on the prices. That said, one never knows with commodities. 🙂 . As a portfolio diversification tool, gold is always an asset that is in contention.