India’s neighbour Srilanka is undergoing a full-blown crisis with shortages of basic supplies like food, medicines & unending power cuts. Even the affluent cannot buy food as shelves in the supermarkets are empty.

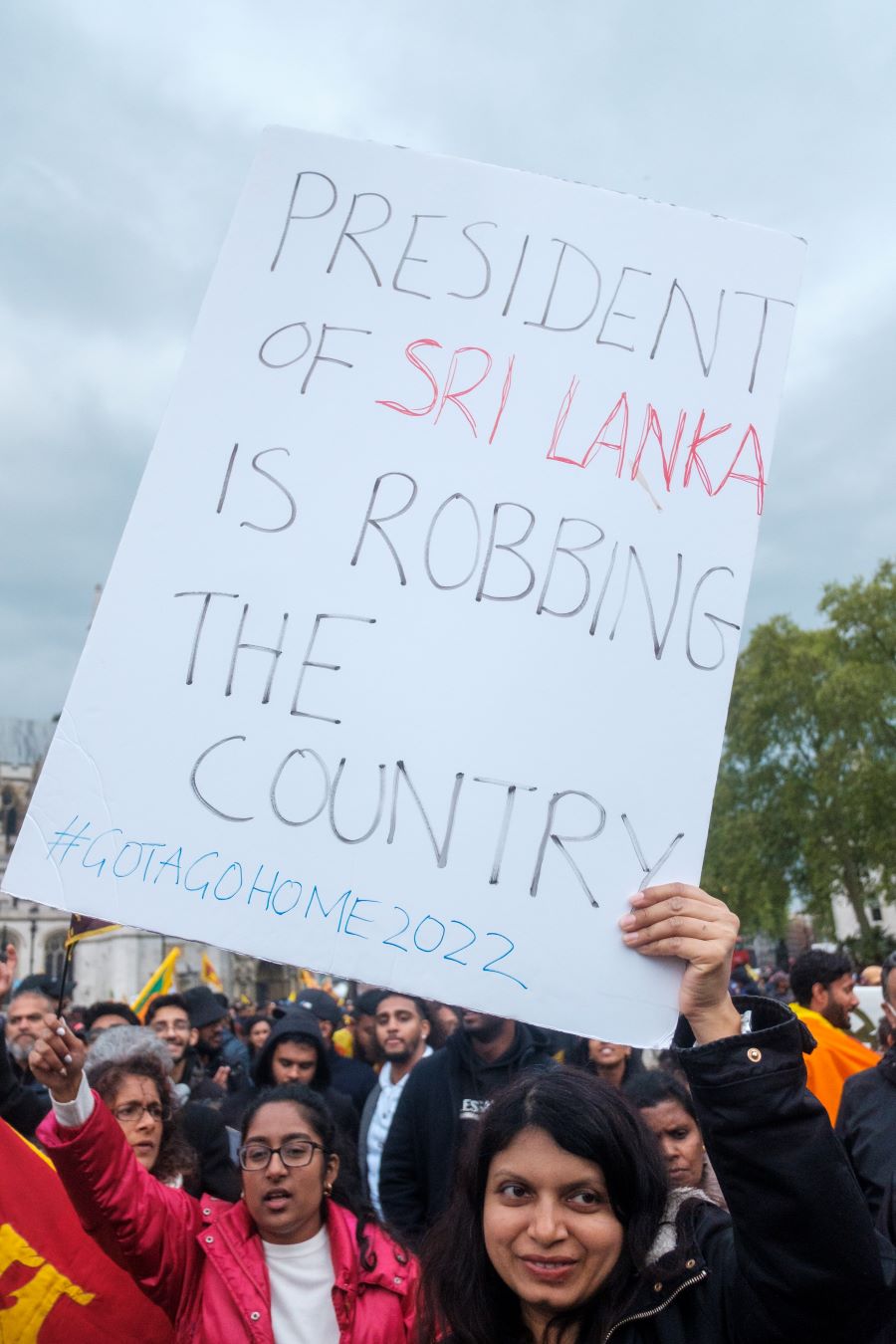

There are massive ongoing protests because of the serious humanitarian problem unfolding there.

How did Srilanka get there?

The Sri Lankan economy has been facing a crisis owing to a serious Balance of Payments (BoP) problem. Its foreign exchange reserves have depleted to alarmingly low levels and it has been difficult for the country to import even essential consumer goods and fuel.

The current economic crisis is the result of the historical imbalances in its economic policies, the International Monetary Fund (IMF)’s loan-related conditionalities, and the misguided policies of authoritarian rulers.

A short history.

- Sri Lanka got independence from the British around the same time as India and had a growing economy. To accelerate growth Sri Lanka moved to an export-oriented and import-substituting economy similar to other East Asian economies which lead to higher costs because of operational inefficiencies.

- When Sri Lanka emerged from a 26-year-long civil war in 2009, its post-war GDP growth (Gross Domestic Product is a broad indicator of a country’s National Income) of was reasonably high at 8-9% per annum till 2012. However, GDP came down after 2013, which led to an increase in the borrowings from abroad (both the IMF and others) which came with their own set of stringent conditions.

- Fuel prices have been historically subsidised (The public has to pay lower than the cost, and the gap is filled by the government, India moved to remove subsidies on fuel some years back). Low fuel prices are a blessing for direct users of fuel but are a drain on the country’s revenues, and ultimately taxpayers have to foot the bill.

- The Easter bomb blasts of April 2019in churches in Colombo resulted in a high number of casualties, consequently, the number of tourists sharply dropped leading to a decline in foreign exchange reserves.

- The newly formed government by Gotabaya Rajapaksa in 2019 implemented the promised lower tax rates – both income tax and Goods and Service Tax (GST) rates and wide-ranging benefits for farmers and popularity but exacerbated the shortfall in Government revenues.

- The Covid-19 pandemic in 2020 made the bad situation worse –

- Exports of tea, rubber, spices, and garments suffered.

- Tourism arrivals and revenues fell further

- Due to a rise in government expenditures, the fiscal deficit. the gap between Government Expenditure and Revenue became very high – above 10% in 2020-21, and the overall Debt (borrowings) to GDP ratio rose from 94% in 2019 to 119% in 2021.

- Sri Lanka’s Fertiliser Ban: In 2021, all fertiliser imports were completely banned and it was declared that Sri Lanka would become a 100% organic farming nation overnight.

- This overnight shift to organic fertilisers heavily impacted food production which reduced drastically resulting in shortages & huge price rises or inflation. Although this was rolled back soon, the damage was done.

- Foreign exchange reserves required to buy crucial imports have fallen to a record low. The current useable foreign reserves have fallen to less than $50 million which is insufficient for even essential imports. This has also resulted in default of interest payments and repayment of foreign exchange loans.

- Consequently, the Sri Lankan President has been off and on declaring an economic emergency to contain rising food prices, a depreciating currency, depleted forex reserves low stocks of fuel and essential commodities

The president’s diktats have resulted in huge protests across the country.

India’s Assistance to Srilanka

- Beginning January 2022, India has been providing crucial economic support to the island nation mainly in supplying essential commodities such as food, medicines, and fuel and financial relief/concessional loans, etc.

- This will strengthen India’s ties with Srilanka whilst decreasing the Chinese influence.

What May Happen & the Possible Way forward in Srilanka

- Srilanka has to increase its revenues and limit borrowing. The existing loan especially foreign will have to be restructured and renegotiated.

- Limiting concessions and subsidies that are given.

- Control illegal refugees entering India’s borders.

What Can India Learn from this?

Having gone through a similar Balance of payments crisis in 1991 India too has lessons to learn from our neighbor’s experiences. A fall out of the current pandemic era and Ukraine crisis are rising Government deficits, increasing overall debt, and soaring inflation – all of which place pressure on our BOP and forex reserves.

India needs to ensure that it never falls into a similar trap, and the public needs to protest vehemently if the government gets profligate with the finances of the nation.

Sasthamani

Simple and clear explanations. These are true and correct too. Countries like India and Sri Lanka should find ways to price fuel in accordance with the purchasing capacity of the citizens. Those who earn higher income should pay more for the petrol and LPG cooking gas. No scooter Day or No cars Day should be introduced even on holidays and Sundays. In order to regain the lost paradise the people of Sri Lanka should now undergo pain. Foreign investments need to be brought in in tourism, agro industry, tea sectors.

Alka Susheel

Well analysed Usha…and interesting to read

Sejal Goel

Very current and relevant topic covered from 360 degree angle, made it so simple to understand. Explained so well with little bit history thrown in. It has given us the food for thought as well…

After this read… I will be able to understand the news with more depth..

Thanks for the insight…..

Suman verma

After reading this, I understood how a developing country could fall into economic crisis trap. And public has to face the consequences. This write-up is very informative and to the point. Great job Usha!

Will look forward to such simple fact base economic feedback from you.

Jyoti Gupta

Such a well written article! Very informative with a clear analysis from history to way forward!