Recently we covered index funds/Index ETFs in a blog, To recapitulate,index funds are pooled investments that mirror an index like the Sensex, Nifty50, Nifty 500, BSE Midcap, BSE Small Cap, Nifty Bank, etc.

It follows therefore to know how & what an index is. It is such a commonly accepted term by people familiar with the markets and it is hard for them even to fathom that others may not understand it.

So, let’s just talk about the stock market.

Companies access the capital markets for funds for their needs. They accept funds from the public at large and issue them “shares” in their business. These shares are listed on the stock exchanges facilitating anonymous transactions in those shares. As long as the buyer and sellers agree, shares get traded at an agreed-upon price.

Business news channels debate non-stop on what the price of a share should be, what could be, and what is driving the price of a share up or down.

The Bombay Stock Exchange has more than 5000 shares listed & the National Stock Exchange has about 2300. Some may overlap and on any given day all of them are going up or down. If one wants to know the general mood of the market there is a need for a barometer or it would just be manic. Some stocks go up, some go down & some are flat.

Therefore Indices were created.

The BSE Sensex comprises 30 of the largest and most traded companies listed on the Bombay Stock Exchange. Large means large by way of market capitalization. Market Cap means all the shares issued by the company * the current market price.The BSE SENSEX was created in 1986. The methodology may have changed a few times but basically, it is the weighted average of the 30 largest companies in the BSE by way of free float market Cap.

Free float – there are a few shares owned by promoters and or institutions that are not traded or under lock-in. These are not taken into account and only the free unencumbered shares are considered when constructing the BSE Sensex.So the BSE Sensex is the weighted average of the 30 largest stocks on the BSE.

Similarly, NSE s NIFTY 50 came into existence in November 1995. It comprises the average of the largest 50 companies on the basis of free-float Market Cap listed in the NSE.

The base value was 1000 in Nov 1995. Today the value is close to 20,000 so we can say that in 28 years the Nifty50 has grown 20 times.

The Sensex and the Nifty 50 are barometers of the market and comprise the largest companies in India from different sectors. When a commentator says that Nifty went up by 5% or went down by 3% on a given day, it just indicates the general mood and the direction of the market or the average % of the rise & fall in the stocks comprising the index. It could very well be that an individual stock rose by 10%, and another fell by 5%. The movement of the index is a guide to how stocks are moving.

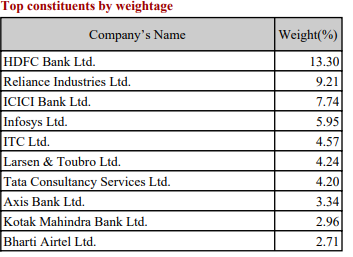

The top 10 stocks of Nifty are as follows

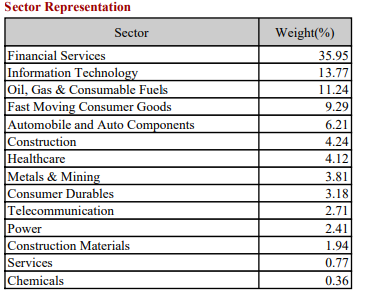

Clearly, financial services, IT, and Oil and gas are the biggest sectors and have the largest representation in the Index.

When you invest in an Index fund, say Nifty50, you will invest in all 50 stocks in the same proportion as the Index. If the index goes up so will your return, there may be a slight variation due to expenses and technicalities. (The fund manager’s compensation & operations costs will have to be accounted for).

The expense ratio is quite low, about 0.25—0.35% as compared to an average of 1.5 to 2% in other active funds.

The ‘Passive’ part of Index investing is that you invest in the broad indices and as an investor you just let it sit. Your return will mirror the broad index returns, no more/no less. On the other hand, an active fund manager can invest in any stock based on his funds mandate.

Why then do I say that a passive fund is not really Passive in the headline? Well, every six months the Index creators review the Index and realign it based on the real-time values.

So if a company has fallen out of favour say a Yes bank or Satyam Computers or other cyclical companies whose prices have fallen, they will be replaced in the Indices based on the formula. The 30/50 largest companies will be part of the flagship indices Sensex & Nifty50. Hence it is a bit boring to invest in Index funds but it is not a static investment.

BSE Sensex & NIFTY 50 are the most popular Indices but there are many others that track different types of sectors & themes. You can the different indices & the performances of their constituents here.

You can find the factsheet of all Nifty indices here & BSE Indices here. One should look into the methodologies and factsheet of the indices as they may vary and then pick a fund that hugs the chosen index.

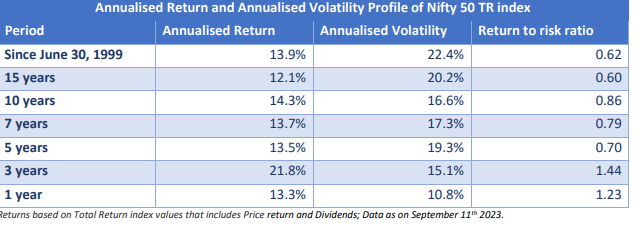

Here is the performance of Nifty 50 (coz it has a shorter history)

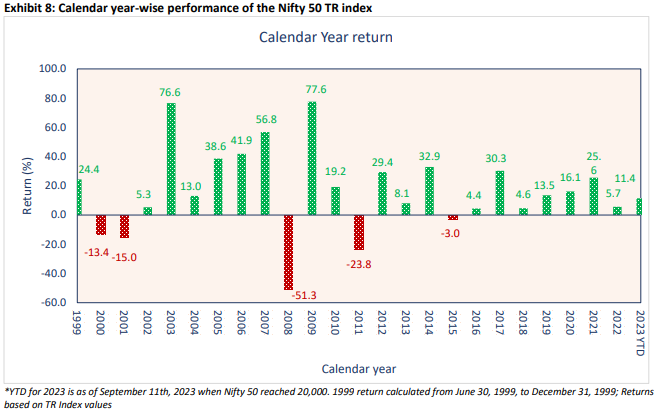

Here is the performance of Nifty, calendar year-wise.

Here is the performance of Nifty, calendar year-wise.

The above two charts are self-explanatory. Past performance may not be repeated in the future, and there may be long periods of negative returns but if an investor had remained invested in a Nifty index fund then she could have got an annualised return of an average of 12% over the last 15 years.

The above two charts are self-explanatory. Past performance may not be repeated in the future, and there may be long periods of negative returns but if an investor had remained invested in a Nifty index fund then she could have got an annualised return of an average of 12% over the last 15 years.

There are times though when the indices have fallen by more than 50% but recovered because the overall Indian economy has been on an upward trajectory. All in all, index funds are a relatively safer option for investment in the stock markets.

To access a complete list of passive mutual funds, click here.

So this blog is not an endorsement of Passive funds but an explanation of what those funds mirror. If Warren Buffett is a fan of passive investing, we better know what it is.

No Comment