Everyone loves to see the underdog win. The loudest clap in a sport will be when there is an upset, where the unseeded, unexpected player or team wins. We like to believe that the small guy can beat the favorite if he just perseveres enough. It is just the way we are.

In 2020, millions of first-time retail investors begun their stock investing or trading journey. Robinhood a new commission-free stock broking App in the US had a wonderful User Interface, clean and easy. It took the elite out of stocks and almost gamified it. The Indian version of Robinhood is Zerodha.

With nothing to do, work from home, no sports watching or betting, no casinos, the stock market, and cryptocurrency seemed to be an easy place to engage and make some money. Over one crore new accounts were opened in 2020 in India as well as in the USA.

Clearly, as many of them were first-time investors, the most googled phrases were, what is the stock market? What is an Index? What is Sensex? In the US, What is S & P 500?

Post the crash of March 2020 & the worldwide lockdown, this so-called “dumb money” had more conviction and optimism about the economy, than the existing veterans of the markets. They bought at every dip and their belief has been rewarded and how.

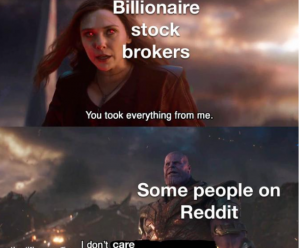

The unfolding of a new phenomenon called MEME stocks has been fascinating.

What are Meme Stocks?

A Meme Stock is a stock where there is a sudden surge in interest fueled by discussions on social media sites and forums.

GameStop or $GME is a Meme stock. It is the largest video game retailer headquartered in Texas, USA. The company was not doing well as could not face competition from online sales.

At the start of January 2021, GameStop’s stock ($GME) was priced at $17.25. On Jan. 26, $GME had reached $147.98 to close the day, up from $76.79 the day before and just $39.36 one week earlier.

The price of $GME more than doubled to $347.51 on Jan. 27, and then the stock reached a high of $483 on Jan. 28, before dropping to close the day at $193.60.

A rise of 2500% in a month.

It has subsequently fallen to 120$ in April, went back up to $300, and is currently trading @ 200$.

How did this happen?

Social media forums like Reditt & Twitter and chatrooms were the fuel behind this rocket ship.

Reditt has many different forums called subreddits, where anyone can join and be a part of the discussion, post questions, and reply to questions. The subreddits can be anything under the sun, some examples are dataisbeautiful, creepy, nottheonion, legaltips, immigration.

Anyone can join the forums which interest them and there are all types of people posting on these forums including sophisticated experts. They have democratized information and knowledge to a very great extent.

Reditt has forums tracking stocks like wallstreetbets, IndiaInvestments, stocks…where discussions regarding stocks take place. Wallstreetbets has almost a crore, users/subscribers.

These forums & Twitter handles were used to swap stock ideas and some ideas caught the fancy of many users.

A group of WallStreetbet users started liking GameStop and recommended it to buy. They use catchy phrases like.

“$GME to the Moon”,

Yolo, You only live once, so make it count, take risky bets.

Diamond hands mean you won’t let go of stock even if you incur losses.

Paper hands mean fold & sell the stock as you can’t bear losses or are satisfied with the gains.

These phrases fired the imagination and they loaded up on $GME stock. The young and the reckless had energy and fearlessness and created history. Add to that celebrities like Elon Musk egging people on Twitter.

The scene was similar to a real-life video game and a battle cry for these investors who were motivated and did not mind burning some money for fun.

Let’s deconstruct the GameStop mechanics. It had three elements, normal retail buying, short squeeze & Gamma Squeeze. Normal buying is normal, placing a buy order with cash from your bank.

First, let’s take shorting and then short squeeze. Some smart users on Wallstreetbets got to know that $GME was a heavily shorted stock.

Traders sell stocks that they don’t own (shorting) which they believe will fall in price. They sell it in the hope that they will buy it at a lower price.

Let’s take a more relevant example for us.

Say, at the height of the pandemic you had a stock of 100 N90 masks and you start selling them to friends and family at Rs.100 apiece. Although you only had 100 of the masks, you sell 2000 of them as you knew that you could go out and buy them for Rs. 70. Or you had a judgment that the price in the market is lower than Rs. 100.

A similar shorting position which is a common phenomenon happened in $GME.

Now suppose you took the money for the masks and when the time came to deliver, the price shot up and you had to buy them in the market for Rs 120, 150, 170. People started buying out the N90 masks on their own and /or someone realized that you were in a soup and cornered the masks.

Shorting is common. A short squeeze is when there is a lot of short interest and the price of the stock starts going up.

In the $GME s case hedge funds had shorted, which some smart wallstreetbet users were aware of. They rallied the whole group together and kept buying $GME. The institutional investors misjudged the power of the WallStreebets investors. They kept buying the stock and as there were no sellers, the price shot up like a rocket.

Or to the moon, as they say.

In the above example, you had sold more masks than what you had and also more than all the stock in your city. And the price of masks kept rising. Some orders you had to cancel and offer them compensation which was a loss.

This was the working of a Short Squeeze.

And there was something else called Gamma Squeeze.

It’s a bit technical but will attempt to simplify. In the stock market either you buy with the cash you have or you take on bigger bets predicting the direction of stocks. It is neither good nor bad but these instruments are one of the ways traders use to make it big quickly.

They are called Futures and Options. You can learn about it here.

Here we are talking only about Options.

When investors buy a call option on a stock say $GME, someone has to sell you that option contract. You pay them a bit of money (the premium) and they make a commitment to deliver you the underlying stock at a future date for the strike price (which you decide beforehand) of the option.

On the future date, if the price is lower, you have the option to lapse it, (do nothing) and lose the small margin or premium. If the price is higher the option seller has to make good the purchase.

The seller of the $GME option has to think about their risk exposure. If $GME rises above the strike price, he will have to buy the stock at the market price and sell it to you for the strike price, incurring a (potentially large!) loss.

When he sells you the option to hedge the risk, he goes into the market and buys a bit of the underlying stock. The amount of stock he buys is typically decided by how much the option price moves relative to a $1 move in the stock otherwise called “Delta”.

“Gamma” is the rate of change of the “Delta” of the option. As Delta and Gamma rise, the option seller gets stressed.

He has to buy more stock to hedge the risk of the option being exercised in the money (i.e. with the underlying price above the strike price). So here we have the makings of the Gamma squeeze.

As call option purchasing volumes on $GME suddenly surged, option sellers had to purchase a lot of $GME stock to hedge. This drove the price of $GME up! As the price of $GME went up, the Delta and Gamma of call options rose of the stock.

Result $GME to the moon.

Actual buying via cash, short-sellers & option sellers trying to cover their positions.

Post the GameStop saga, there have been other Meme stocks like Blackberry ($BB), AMC Entertainment ($AMC), Nokia ($NOK), Bed Bath & Beyond ($BBBY), but none have made quite a move like $GME.

This post is not to romanticise casino-style betting in the stock markets or reckless behavior. Most of the Meme stocks are not fundamentally strong companies and no one should invest with abandon.

It was just fun to see…

the power of the humble retail and small investor, who moved the mighty huge hedge funds mountains, never to be taken for granted again.

No Comment