As far as investment goes, we are living in a confusing time. After a stellar run the last couple of years, this year the stock indices have given negative returns. Sensex was trading @ 58500 odd, Nifty @ 17440 at the beginning of the year, right now we are trading close to Sensex @ 55900 & Nifty @16600. The outlook for stocks is hazy. Inflation is eating into returns all over the world, a recession is expected in the western world and we may very well be caught in it as well.

It follows therefore that we as investors may not look at allocating more money into stocks till there is a reasonable certainty that the earnings of our companies are stable or on an upswing.

Central banks all over the world are raising interest rates to combat runaway inflation. Interest rates in the system have started rising from near zero rates. The opportunity, therefore, is to choose good entities and earn a higher fixed & predictable return. Fixed income investing is the one which has a greater appeal as, if not anything at least our principal remains protected.

Fixed deposit of scheduled commercial financially strong banks and good AAA-rated corporates is the natural choice of investors. Small Savings also has a good appeal.

From very low dismal FD rates in the last few years, now rates have improved to the relief of pensioners. One can check indicative bank fixed deposit rates here.

Naturally, some banks & branches may offer better rates. In any case, typically you get about 5.5 to 6.5% fixed deposit rates for three years from banks. Higher from some good quality corporates which may be 7% +for three years. The catch only is that the interest income is fully taxable. If you are on a high tax slab, the post-tax return is low.

Even so, the question which arises is whether there are any options in the mutual fund space to get a fairly predictable return with low risk. Normally in a rising rate environment, most debt funds will give low or negative returns. There are some exceptions like liquid, floating rate funds fixed maturity plans in its earlier avatar.

Debt funds invest in bonds and bond prices typically fall when interest rates rise. Most debt funds have given dismal returns lately as interest rates all over the world are being hiked. Our Central bank has hiked interest rate by 90bps or 0.9% this year and may even hike further to stem inflation.

The question which follows is whether there are any tax-efficient ways to invest in a safer debt option.

Target Maturity funds are a good option to lock in higher yields with low risk. They are debt funds that invest in government securities and bonds. They are open-ended, meaning one can invest in them anytime but the fund matures on a fixed date.

You have to do a bit of digging to ensure that they invest in safe bonds, i.e. government-owned, state government-owned, or safe AAA-rated corporates.

You can invest in Target maturity funds of Asset Management Companies (Mfs) or exchange-traded funds.

ETFs or exchange-traded funds are bought and sold via the exchange via your stockbroker. If there are not enough buyers and sellers in that particular security, we may not get the right price when we transact. Therefore if you are buying an ETF make sure you are buying close to the INav (Net Asset Value) which is published by the fund and also available on the Amfi site every day.

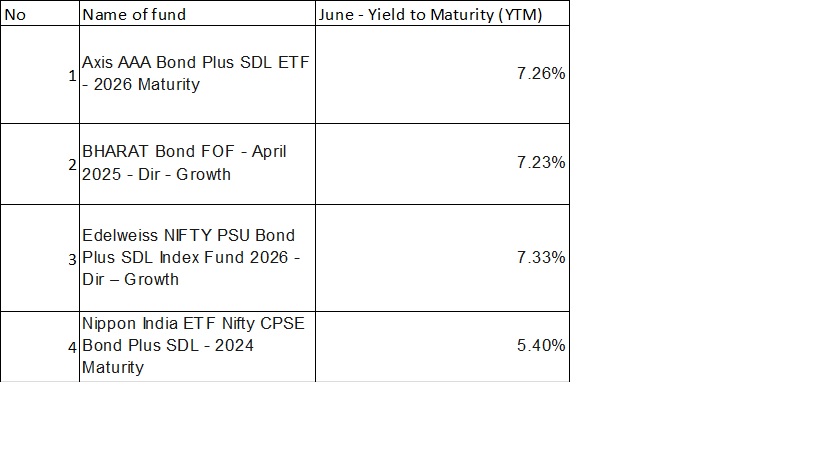

Here is a list of a few Target maturity funds/ETFs.

There are more than 40 mutual funds with target maturity dates. If you see the above there is a year in the fund name. For the exact maturity month date you have to see the factsheet of the fund which is available easily on the site of the mutual fund. You can check a couple of factsheets here & here. The YTMs or yield to Maturity will be mentioned in the quantitative indicators.

Typically the return which you can expect will be close to the YTM you invested into. The most important piece of the pie is that debt fund taxation, if you hold the funds for three years ,the capital gains of a debt mutual fund is taxed at 20% after providing for indexation. With high inflation, the cost inflation index also will be higher reducing the tax by increasing the cost of acquisition.

This will make a post-tax return attractive. You can check the taxation of mutual funds here & here.

Bear in mind that though, you will get all the returns post maturity. So if you need income, a fixed deposit with a regular interest payout may be a better option.

No Comment