Debt Mutual funds in India were dealt with a body blow in the last week of March 2023. The finance ministry via an amendment cancelled the income tax benefits that they enjoyed. Up until the last financial year, if a person stayed invested for three years in a debt mutual fund then their cost of acquisition would be increased via the Cost Inflation Index and the gains would be taxed as long-term capital gains @20%.+surcharge.

Post the amendment the tax benefit of increasing the cost of acquisition via cost inflation index and long-term capital gains has been rescinded.

Irrespective of the holding period, whenever a person redeems their investment and if there is a gain, it will be added to the income of the investor and taxed at his slab rate.

The advantage of the cost inflation index and the lower tax rate was very significant in a person’s decision in investing in a debt mutual fund. The effective net return worked out to be higher in a debt mf as compared to other comparing fixed income products even if the gross return was the same.

It is a body blow to debt mutual funds and how the investor and the fund industry react to the challenge will be known in this financial year.

This change is a fait accompli and it’s pointless to lament about it, although it is very tempting to do so. The only saving grace is that the investments in debt mutual funds made before 1 April 2023 still enjoy the tax benefits.

In any case, this year a recession and slowdown are a possibility so equity looks to be range-bound, and interest rates have been raised to control inflation and are at a fairly high level. A debt allocation is certainly on the cards but needs a rethink on the actual vehicle of investment.

Let us reassess and relook at the products for your debt investments.

- Bank Fixed Deposit:

Plain old vanilla products will come back in fashion. Banks are offering quite good interest rates, close to 7.5% for 3 years and higher for senior citizens. For a comparison between the rates and the different tenures, please click here. Please keep in mind that the insurance for bank balances is Rs.5 lacs. Also, do read our earlier blog on Bank deposits here.

- RBI Floating rate Bonds: Extremely safe option, invest only if you can block the money for 7 years.

Current rate of interest is 8.05% ..( NSC rate + 0.35%)

Tenure: 7 years

Interest rate Payouts : Half yearly

Quite an illiquid product. Cannot easily redeem prematurely. Cannot be pledged.

- Tax-free Bonds: IRFC, NHAI, REC, HUDCO, NTPC issued tax-free bonds almost 10 years back. These are great no-brainer options if you are in a higher tax bracket. They only have a payout option and typically the lot size is Rs. 10 lacs. These are available at a tax-free yield close to 5% depending on the maturity or issuer. You need to talk to a voice debt broker or check out debt platforms like Goldenpi, Indiabonds, INRbonds etc to buy these.

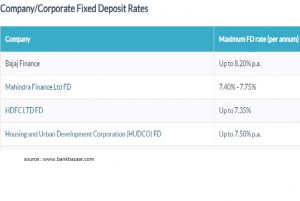

- Corporate and NBFC FDs:

These are somewhat riskier but if you take some effort then a few strong corporate houses and NBFCs regularly offer Fds at good rates. Check out the credit ratings and opt for the safest possible ones. It is difficult to say offhand which are safe but credit rating is a place to begin with. Take the advice of an experienced advisor.

- Corporate & NBFC Non-Convertible Bond Issues: From time to time there are public offers of NCDs. Again it is a bit harder for a retail investor to discern between good and not-so-good offers. It helps to take the advice of an experienced advisor and it’s a good idea to start with the credit rating of the issue. Anything lower than an AA+ rating is an avoid for the novice investor. Recently Muthoot Finance offered NCds close to 8.5% for retail investors, and Cholamandalam NCD offered close to 8.3% whose issue may close soon.

- We have written before on Government Securities which is a no-risk option. Keep in mind that although safe, for retail investors selling these at the right price may not be easy.

- Apart from these our good old post office’s small savings may start looking good at these rates as well. National Saving Certificates, Kisan Vikas Patra, Post office time deposits, etc. all close to 7.5%.For seniors, the senior citizen savings scheme offering 8.2% up to a limit of Rs 30 lacs is very attractive. You can get the rates at the post office here.

- We would categorise Gold also a quasi-debt product. Gold does appreciate from time to time but does not produce any income so not included in this blog.

From time to time it’s prudent to relook at the safe options available for investors. As usual, every product has to be evaluated in terms of the suitability of the product for a particular individual. It helps to diversify even in debt products to create an optimised portfolio.

Despite the tax bomb, one should still consider debt mutual funds for the diversity and liquidity the category offers. It can also give handsome risk-adjusted returns if you can catch the interest rate cycle right.

Chirag

When I began earning as a enthusiastic young adult who began to earn and wanted to save up, KVP were the best options in early to mid 80s.

Today reading about post office schemes transported me to that time.

Life feels like a full circle.

Well written and well received article. Thank you.

Amita

Many thanks @Chirag